"But this I will say to you: your Quest stands upon the edge of a knife. Stray but a little and it will fail, to the ruin of all. Yet hope remains while all the Company is true."

-- Lady Galadriel to the Fellowship of the Ring

The Fed's Quest Stands Upon the Edge of a Knife

by BPA, 12/12/2022

www.RevolutionVenture.com

"But this I will say to you: your Quest stands upon the edge of a knife. Stray but a little and it will fail, to the ruin of all. Yet hope remains while all the Company is true."

-- Lady Galadriel to the Fellowship of the Ring

Today, it is hard to discern the truth. It is obscured in a swirling blizzard of agenda-driven news, propaganda, and disinformation.

We find ourselves coming through an unprecedented decade and a half of events that, to many, would have seemed impossible not too long ago. To name just two:

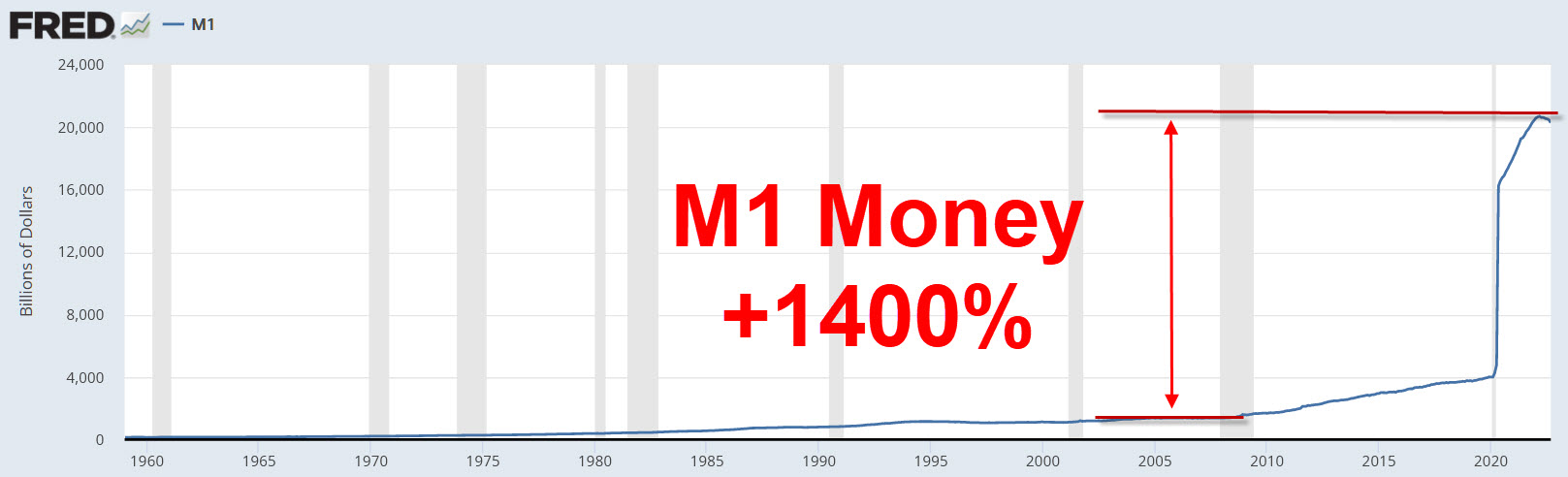

-- US M1 money supply being increased 1400% from 2007 to 2022.

-- Interest rates near zero (and sometimes below zero) for much of a decade.

Many thought that such an increase in money supply would of course result in gigantic inflation (using "inflation" here colloquially to mean an increase in prices and CPI).

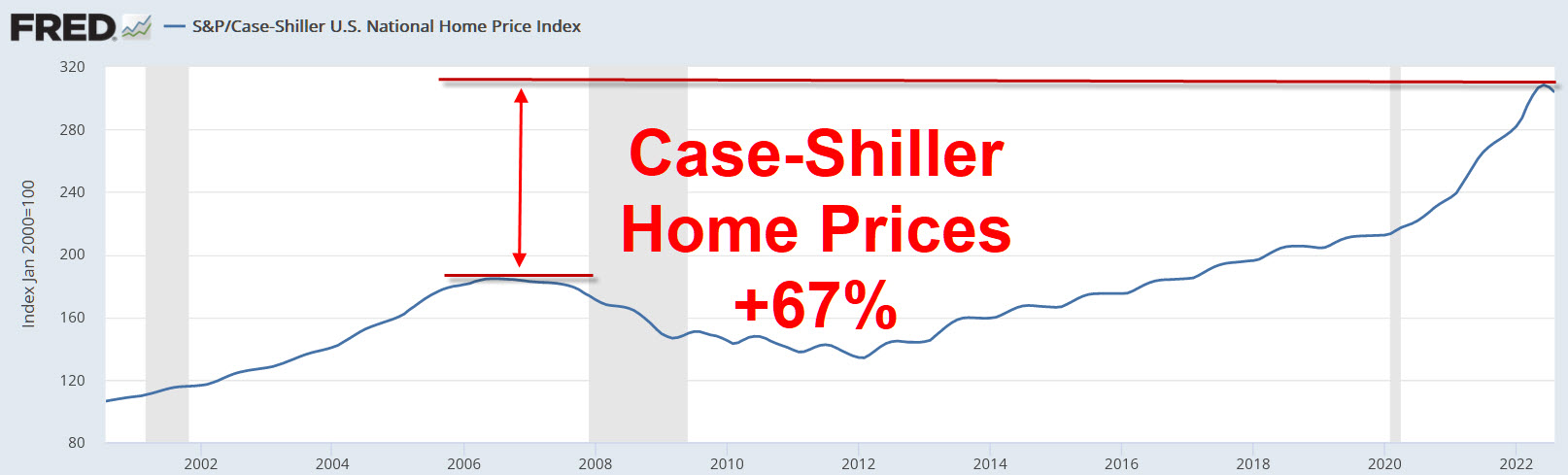

At first, though, the gigantic increases were only in stocks, bonds, real estate, and debt. From levels prior to the 2008 crash onward:

-- S&P 500 up 210%.

-- TLT bond ETF up 75%.

-- Case-Shiller home-price index up 67%.

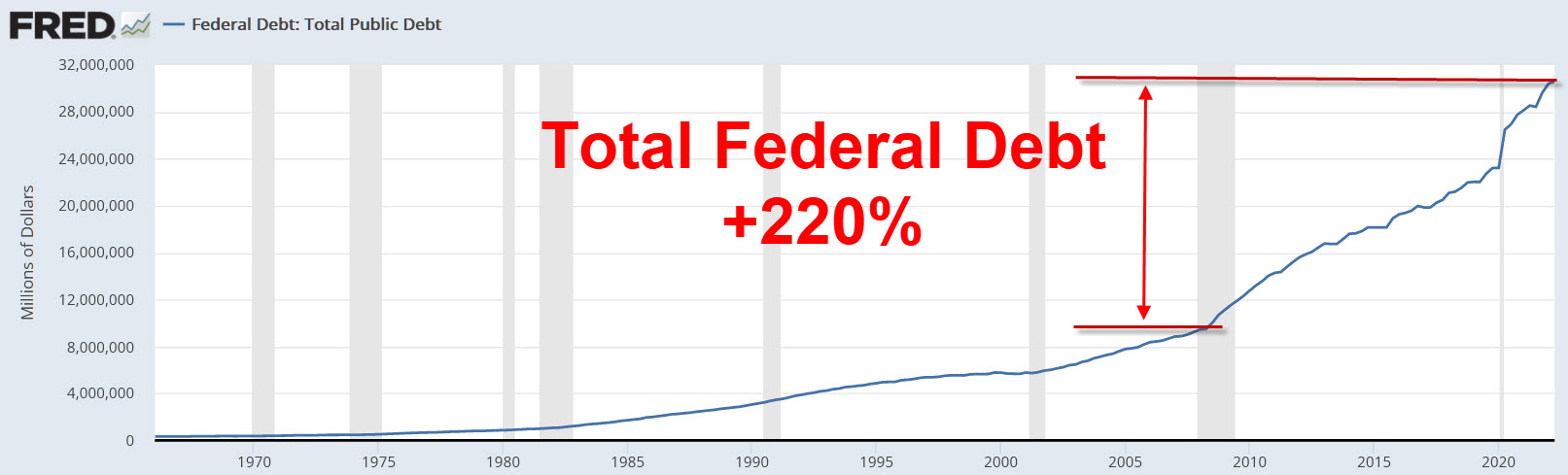

-- Total Federal debt up 220%.

So while the Everything Bubble clearly inflated, there were arguments put forth on how we could print enormous amounts of money and not get corresponding increases in CPI.

Unsurprisingly to many, after some years of waiting, we are finally seeing large inflation in CPI, currently officially at about 7%. Official inflation numbers are subject to fudging (through hedonic adjustment, etc.). The government is incentivized for the inflation number be as small as possible (because some payouts are indexed to inflation). If we were to calculate our inflation on the same basket of goods as in 1990, inflation would be 11%; or if using the 1980 basket, 15%. See Shadow Stats: http://www.shadowstats.com/alternate_data/inflation-charts

We consumers who buy food, gasoline, appliances, clothes, and pay rent -- we know that actual, experienced inflation is very high. To summarize then, the Fed created huge sums of money. People situated near the mouth of the gravy pipe got huge net-worth increases, and the more-distal plebeians got huge price increases.

This is not a dynamic favorable to social cohesion.

In addition, increasing inflation eventually wrecks businesses and a nation's currency. That is painful for everyone, elites included. You end up with a house that is worth $millions, but a loaf of bread costs a wheelbarrow of money, like in the Weimar Republic. Or we see ourselves in The Mandibles, by Shriver (a fabulous book for our times).

Unfortunately, the corrective action is painful, too. Removing enough liquidity to cure inflation can pop the Everything Bubble and result in a depression. Crashing stocks and bonds. Higher mortgage rates. House prices diving. Businesses failing. Unemployment rising. But at least the nation's currency isn't ruined, and we could emerge with an economic system purged of crazy excesses, ready for real growth from that new base.

What will the Fed do?

Well, there is another factor. Our government has so much debt that it seems it will eventually need interest rates to be low in order to pay interest. The Federal government has $30 trillion in debt. It pays about $500 billion in interest per year. That is an effective interest rate of 1.7%. If the interest rate went up to 5%, it would pay $1.5 trillion per year in interest -- perhaps too high to afford. Thus, if the Fed holds interest rates low, inflation keeps rising. And if the Fed raises interest rates to fight inflation, it could become hard or impossible for the government to pay the interest rates. The US debt/GDP is 120%. There are only a few ways to handle enormous debt: default (not likely when the nation can print money to make payments), inflate it away (a common method with ruinous consequences), or grow out of it (preferred, but hard when debt/GDP is large, see This Time is Different, by Reinhart and Rogoff).

There's enormous pressure on the Fed to lower interest rates now. Those with short-term goals (politicians in office, various businesses, Wall Street, etc.) would love that -- for a little while. Stocks, bonds, real estate, debt, and perhaps especially gold, silver, and commodities would skyrocket. But ruinous, currency-destroying (maybe nation-destroying) inflation could follow. A lot of people believe that the Fed will give in and lower interest rates.

But -- the Fed could keep jacking up interest rates to quickly pop the Everything Bubble. Stocks, bonds, and debt would crash quickly. Then the Fed could crank interest rates back down. There would be a lot of pain. But there is a slim possibility that the crash is short -- yet still purges enough excess so that we don't go right into runaway inflation, and get real growth from the new base. The government continues to pay its debts. We solve our high debt/GDP with a brief depression (lowering debt) followed by less inflation and more growth (increasing GDP).

So maybe hope yet remains.

Maybe the Fed is trying for this path upon the edge of a knife: the chance to avoid ruin on one side (runway inflation) and ruin on the other (long-term depression).

-end-